- Home

-

Govt

Government Officials Qin Weizhong Tao Yongxin Chen Qing Zhao Yong Zhang Hua Dai Jintao Luo Huanghao Wang Wei Lu Wenpeng A-Z List of Government Agencies Districts Sister Cities Sister Cities Friendship Cities Government Gazette

- News

-

About SZ

Profile Preface Shenzhen Basics High-Quality Development Rule of Law Urban Civilization People's Wellbeing Sustainable Development Videos Photos What's On

-

Services

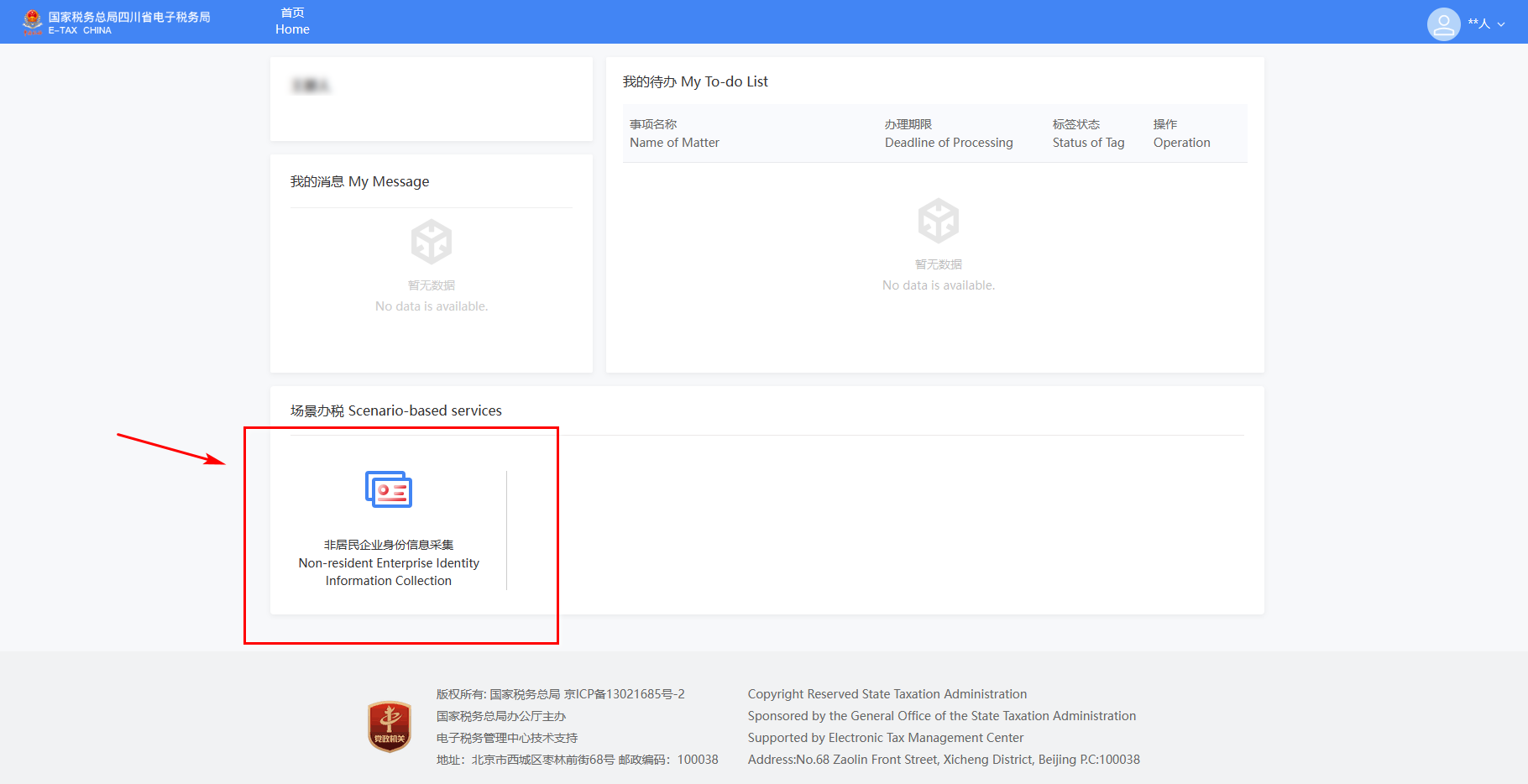

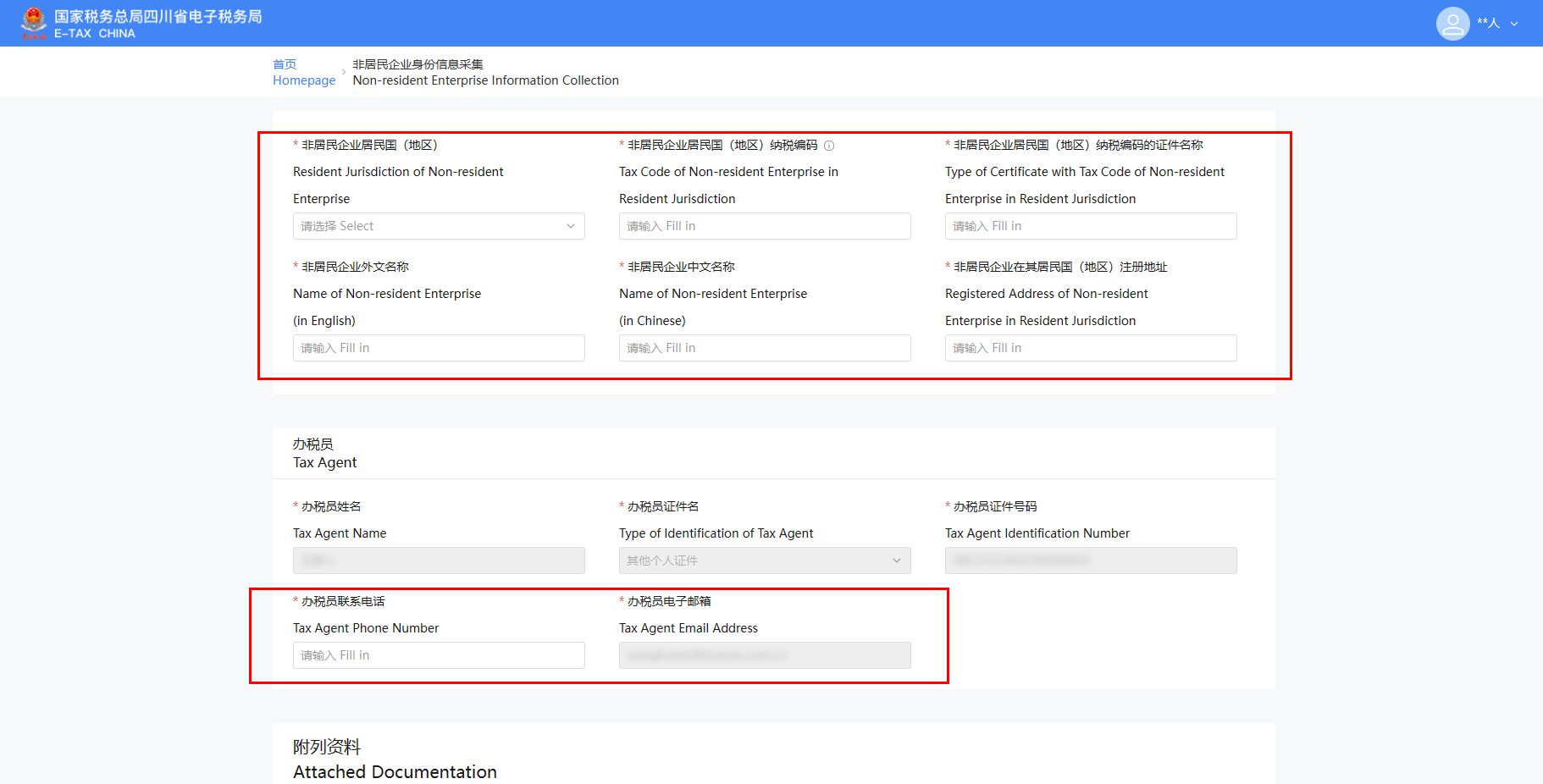

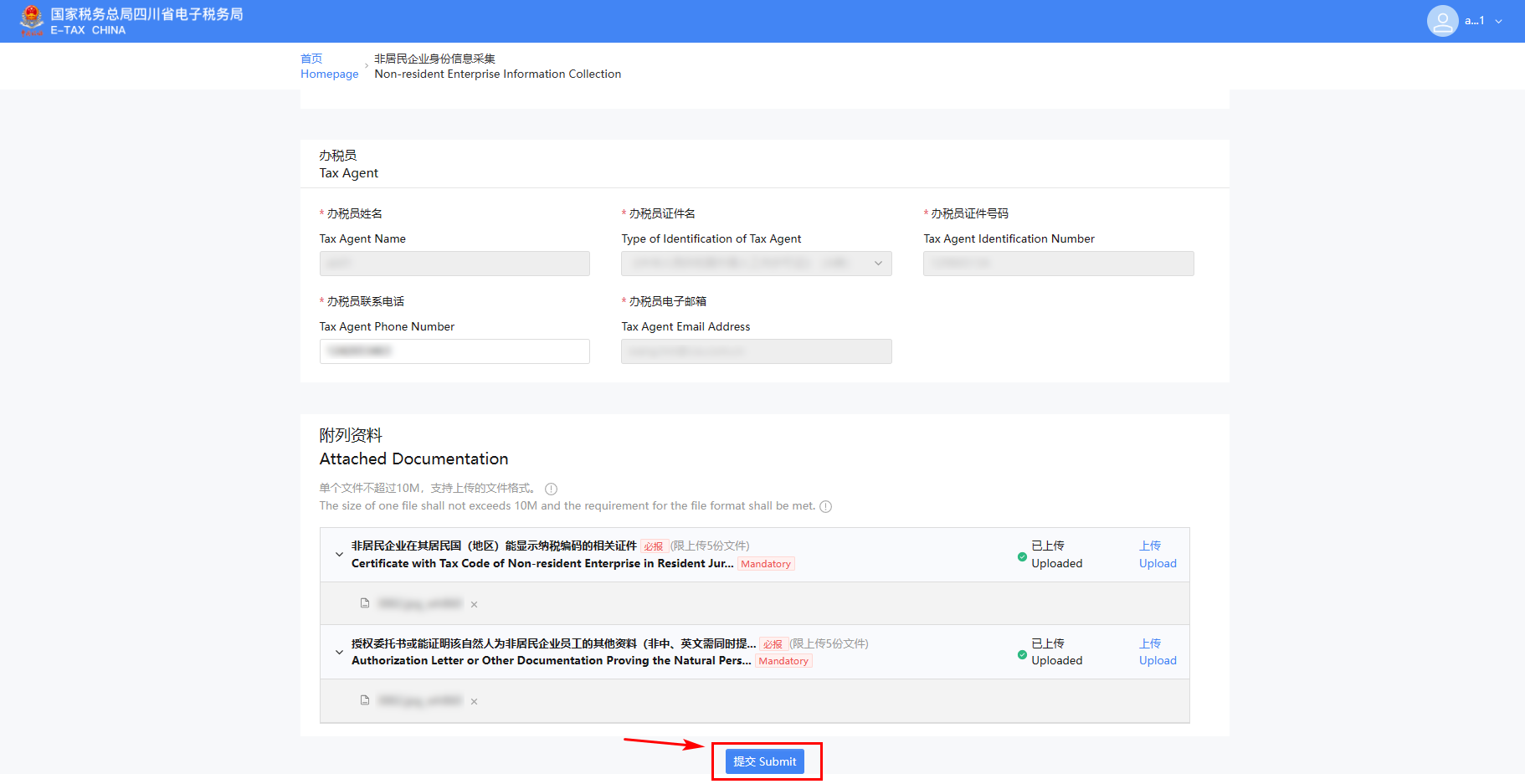

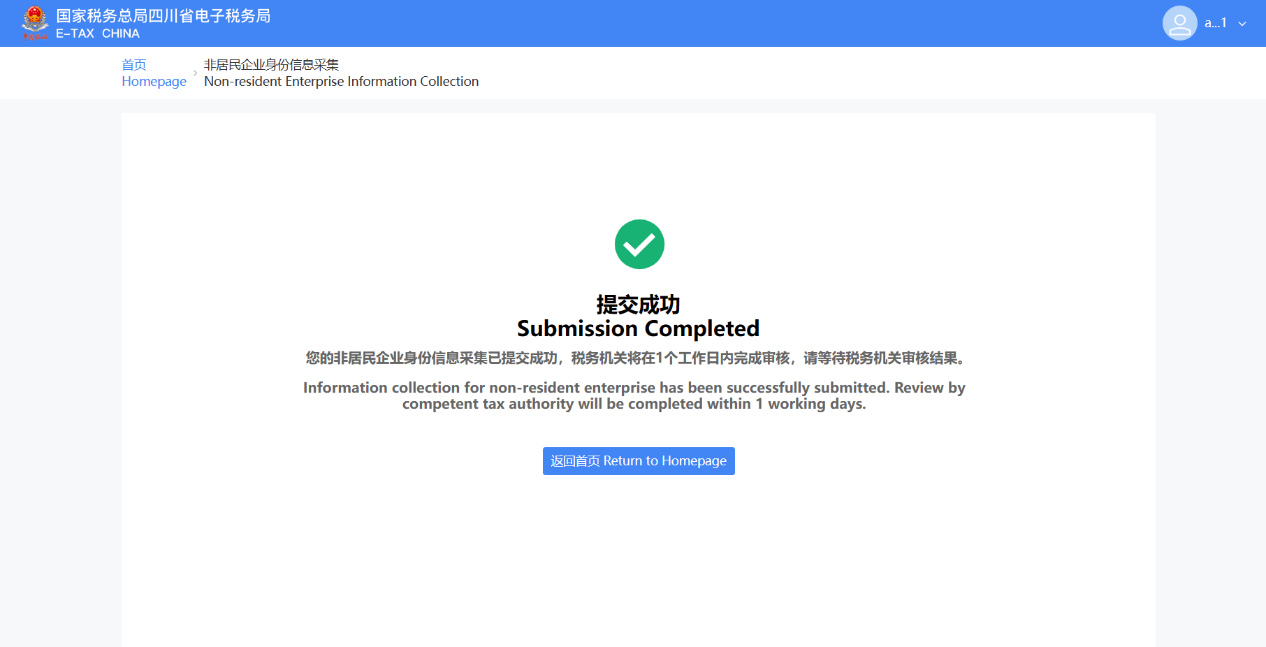

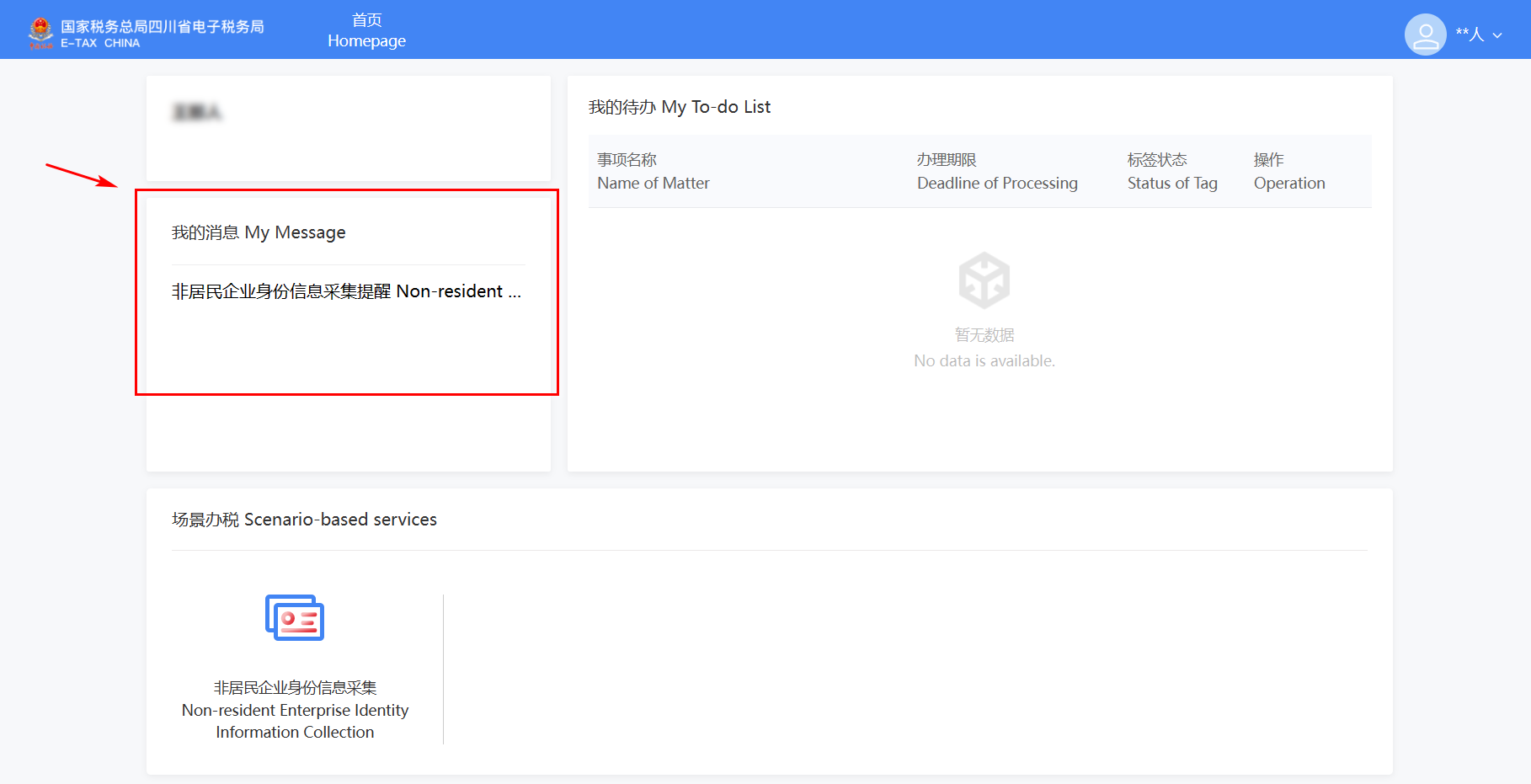

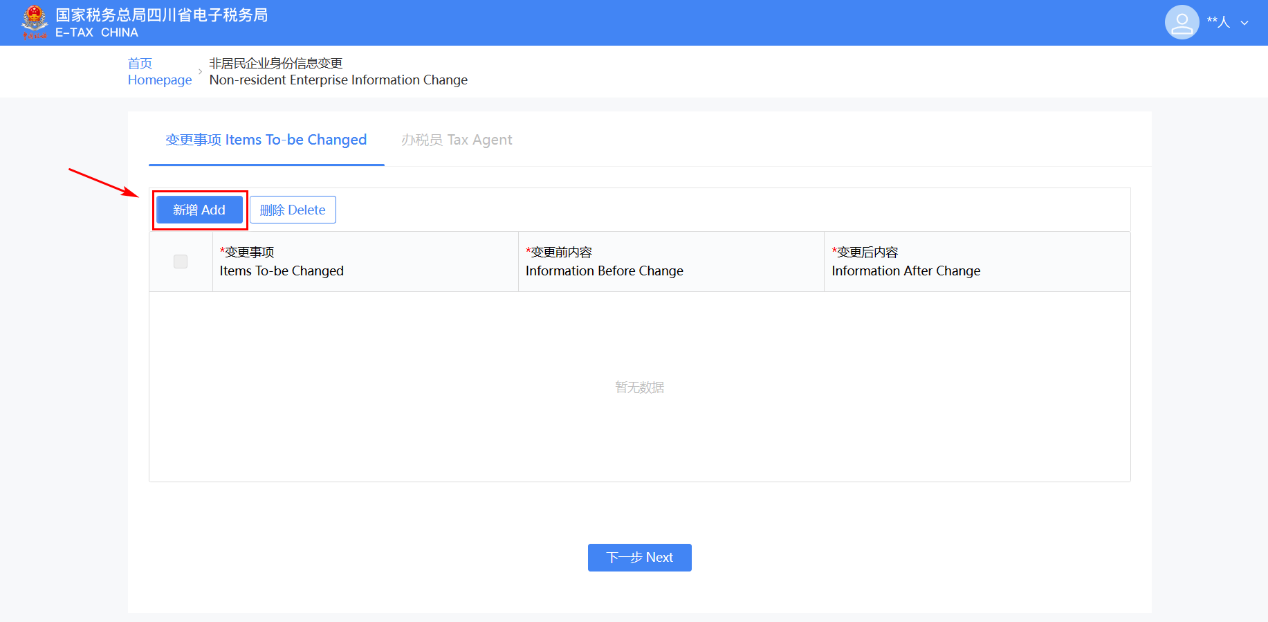

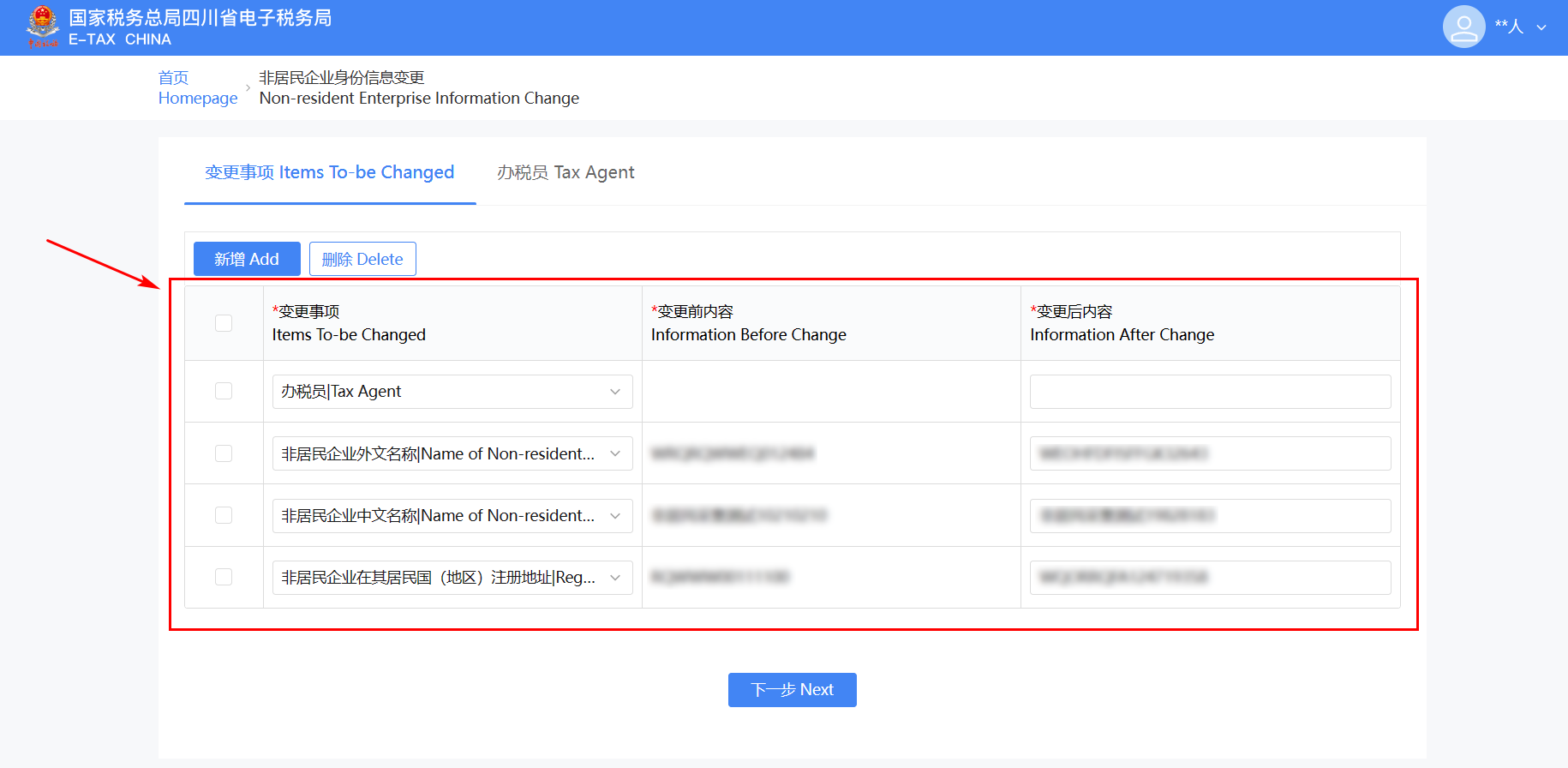

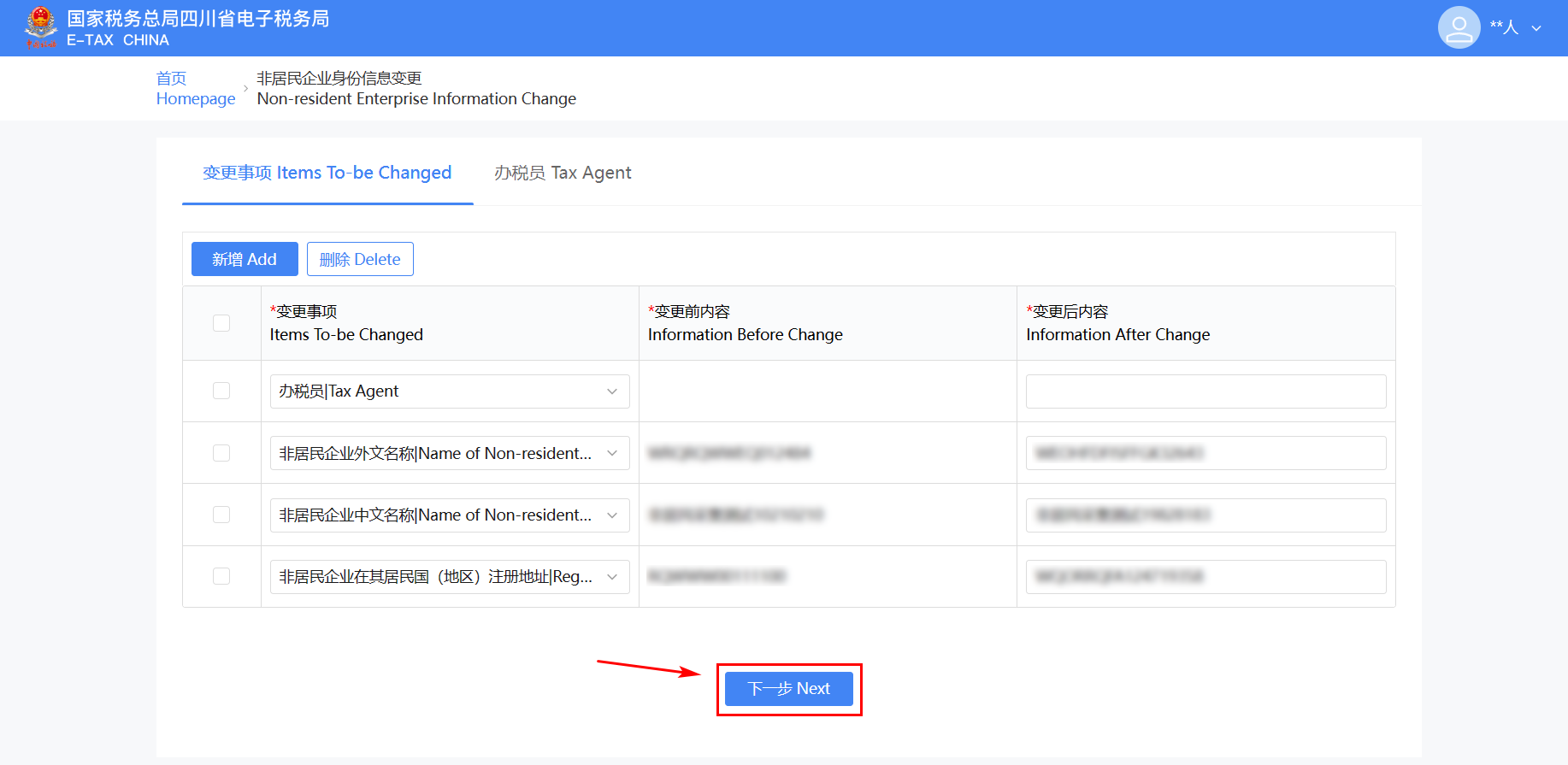

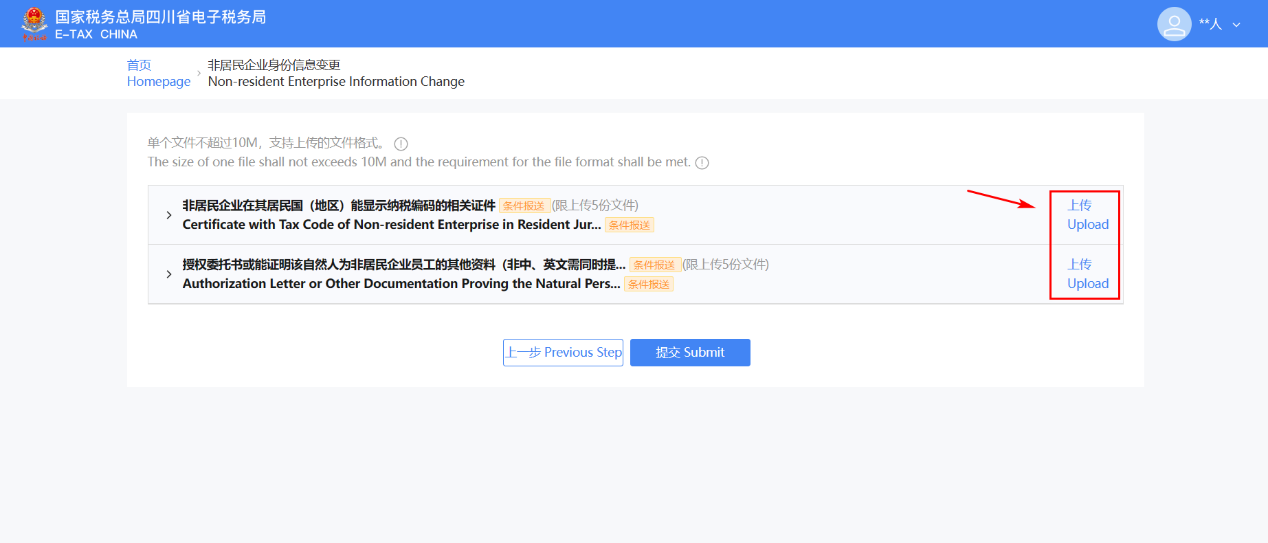

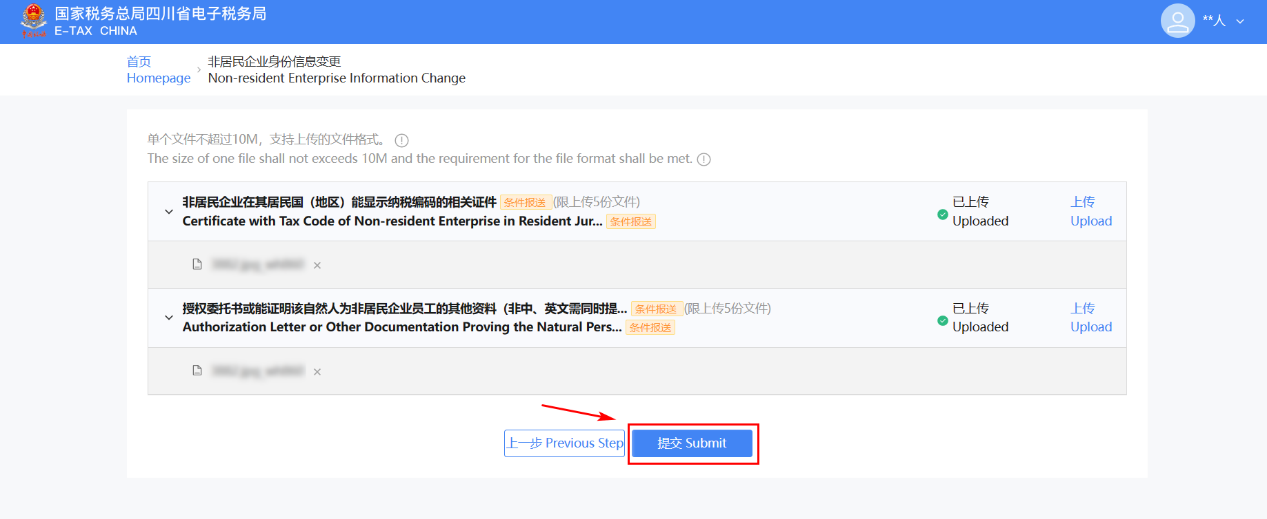

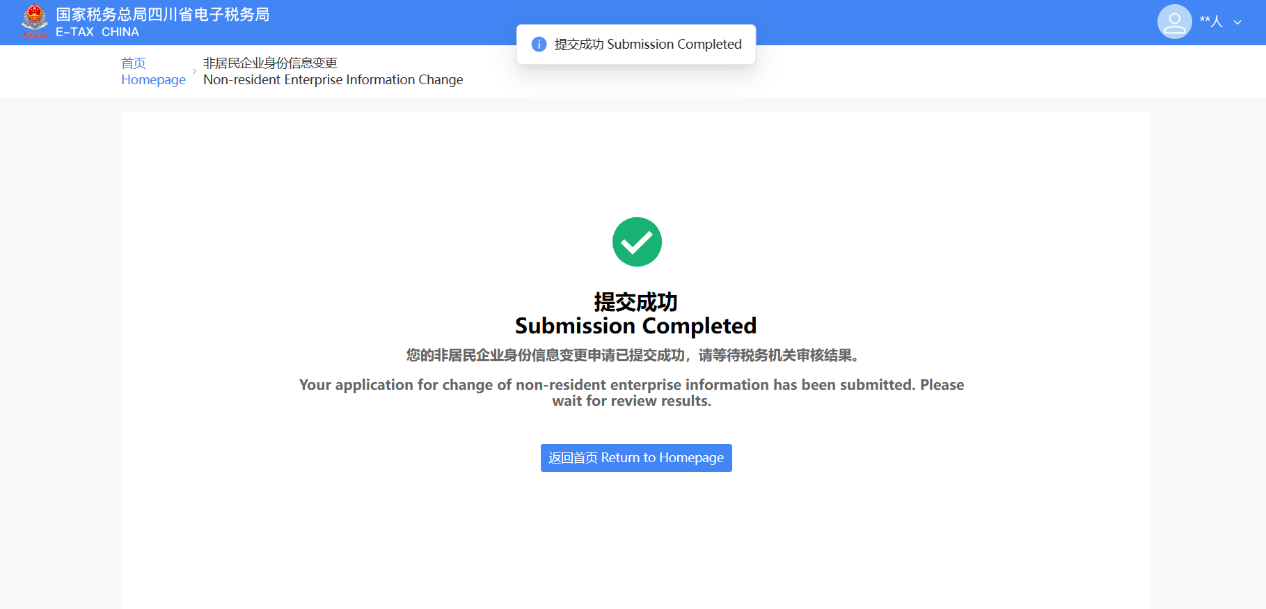

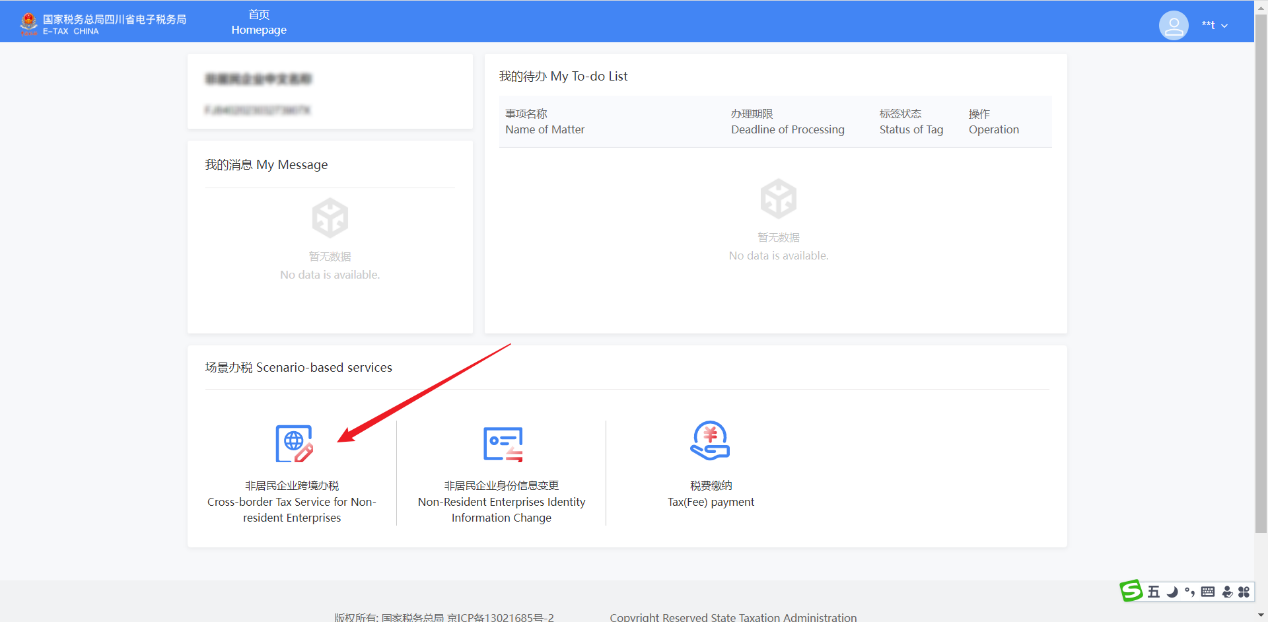

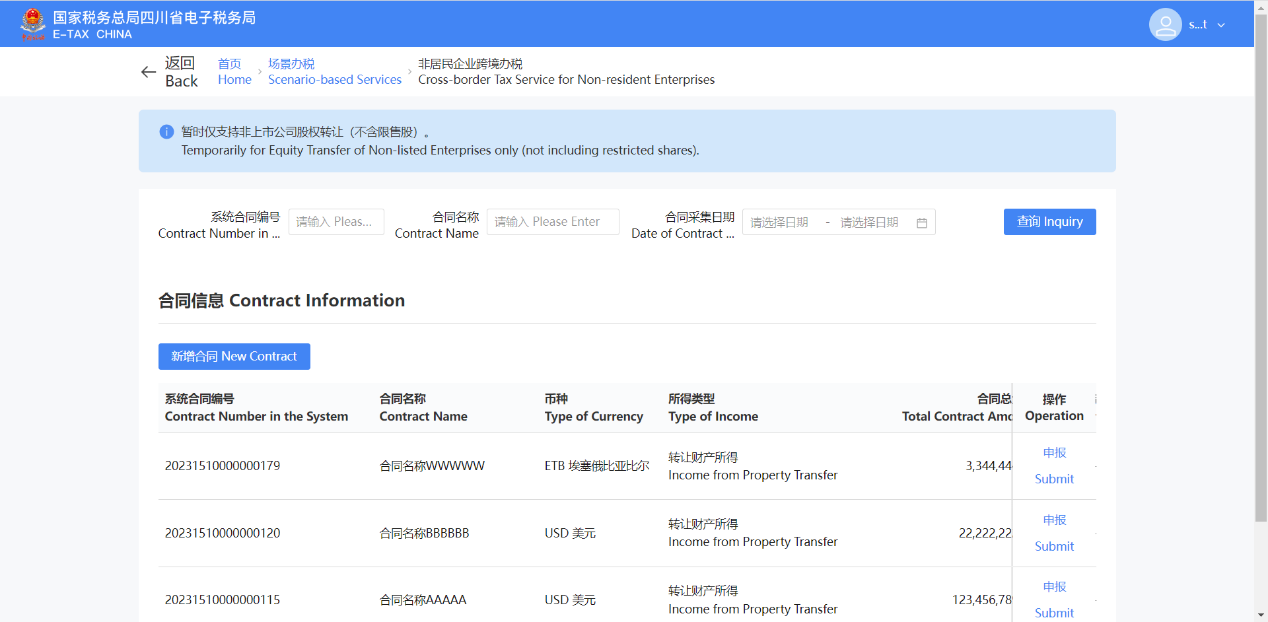

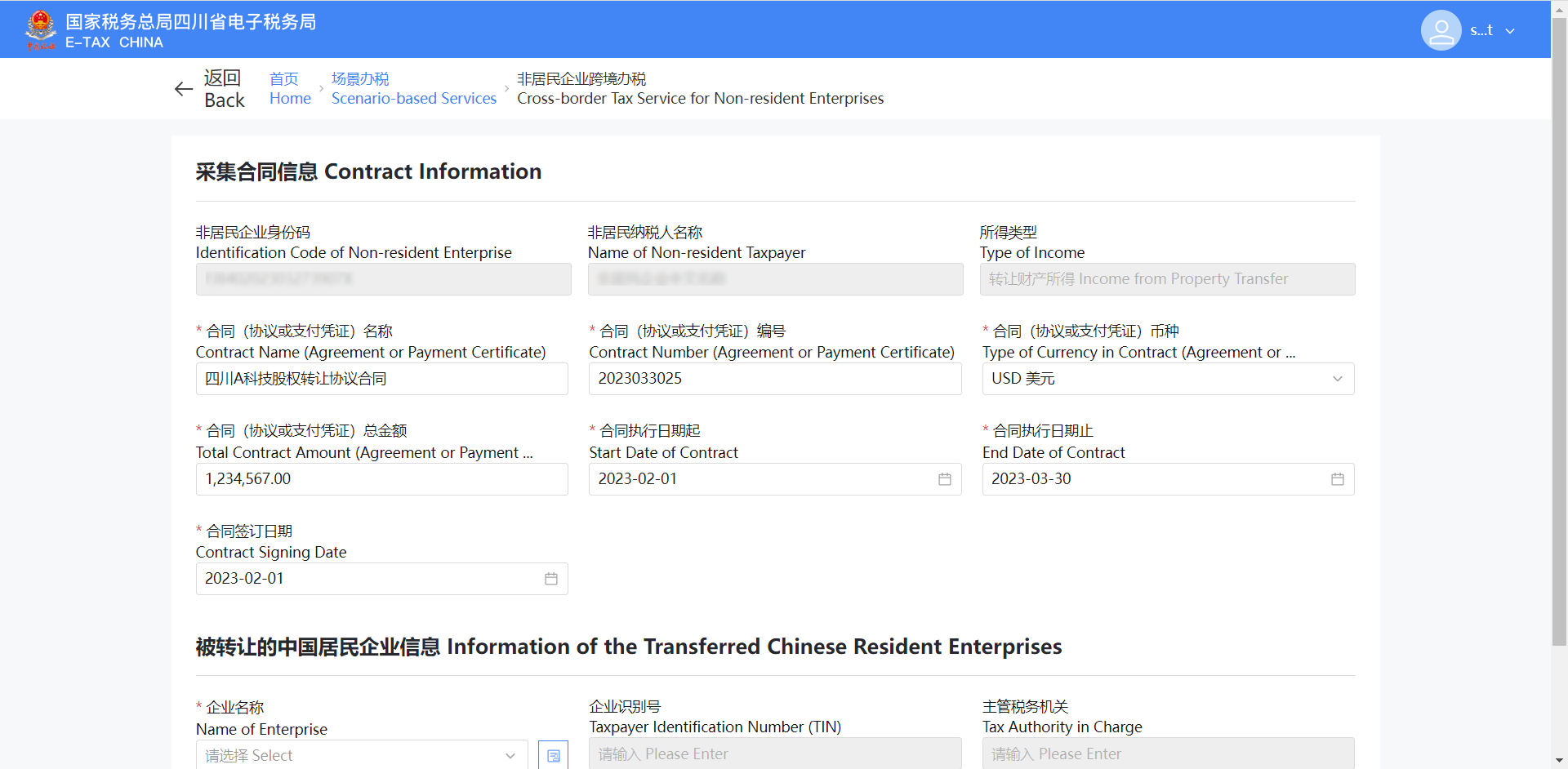

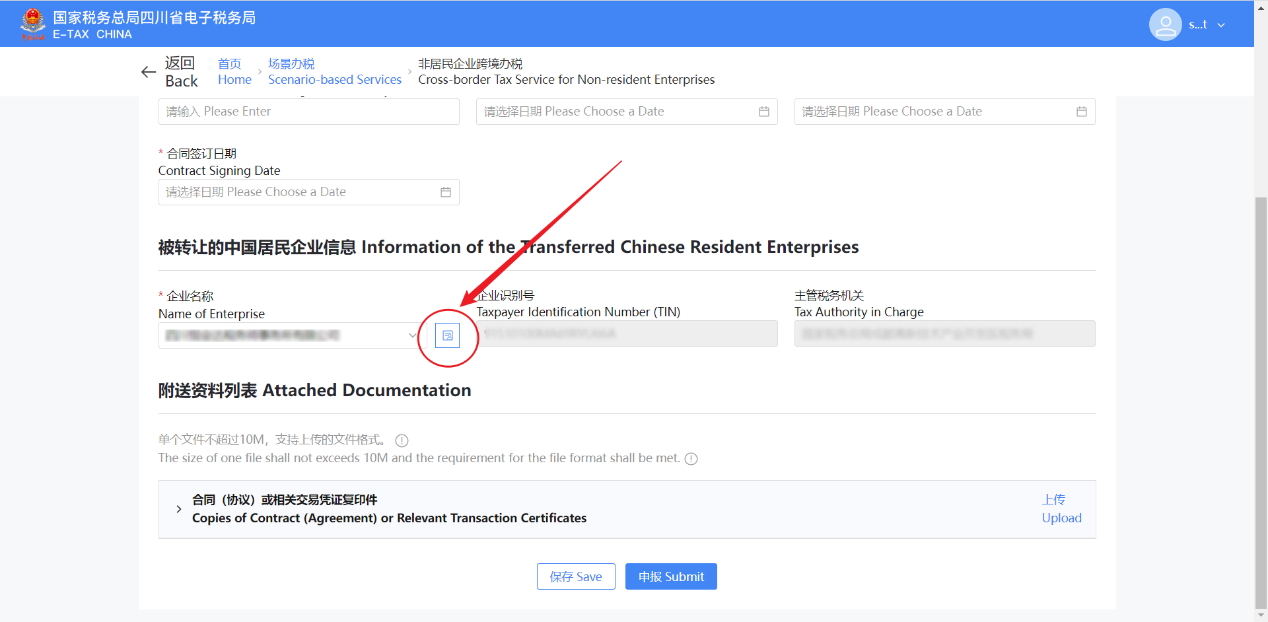

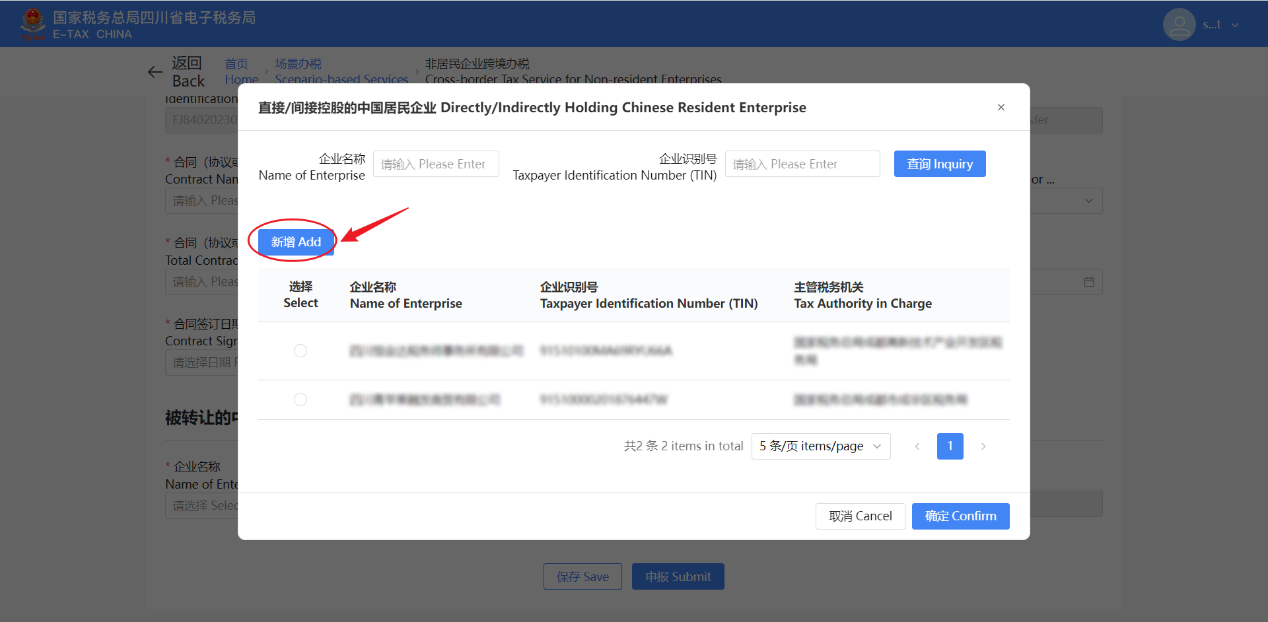

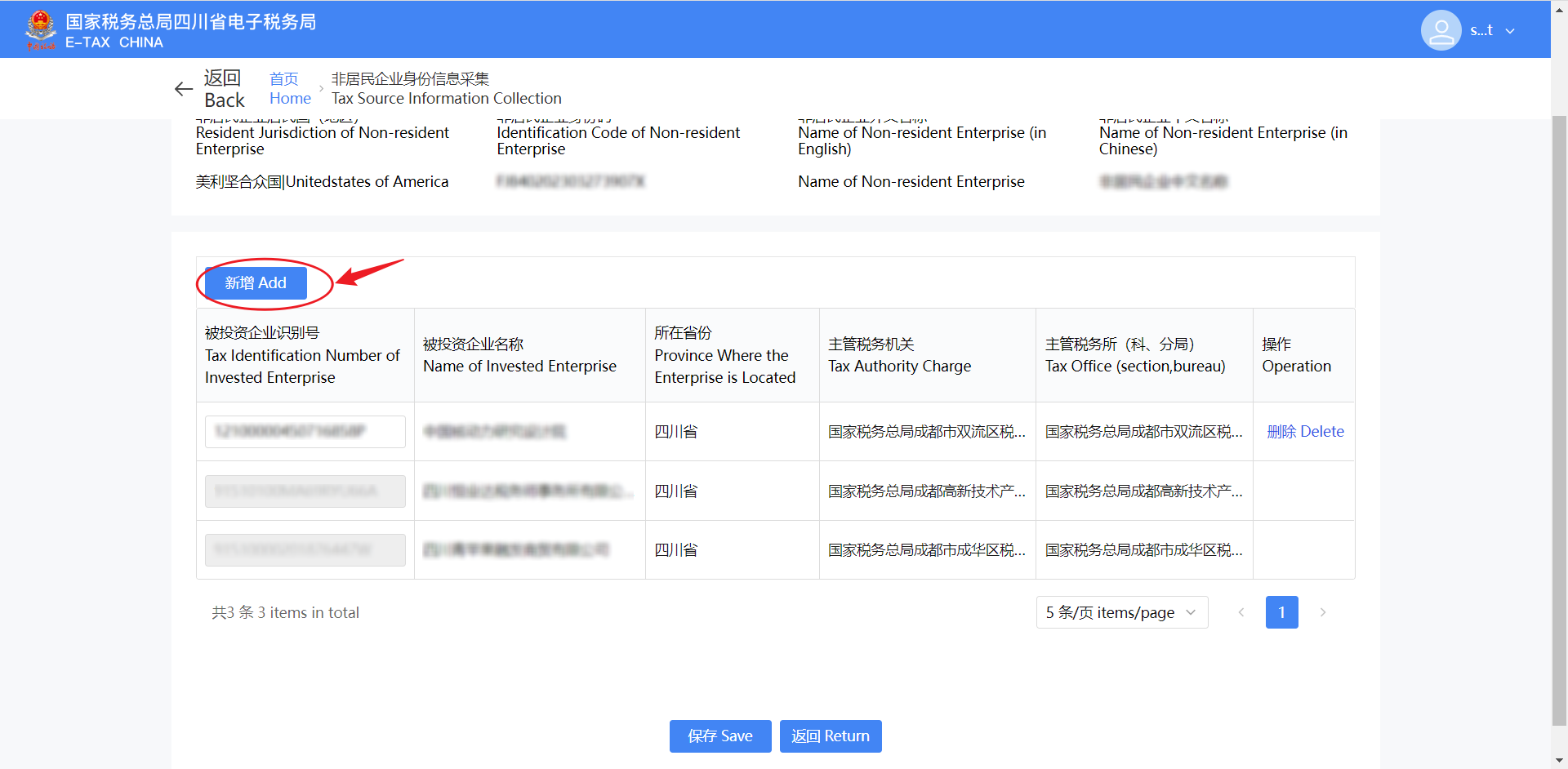

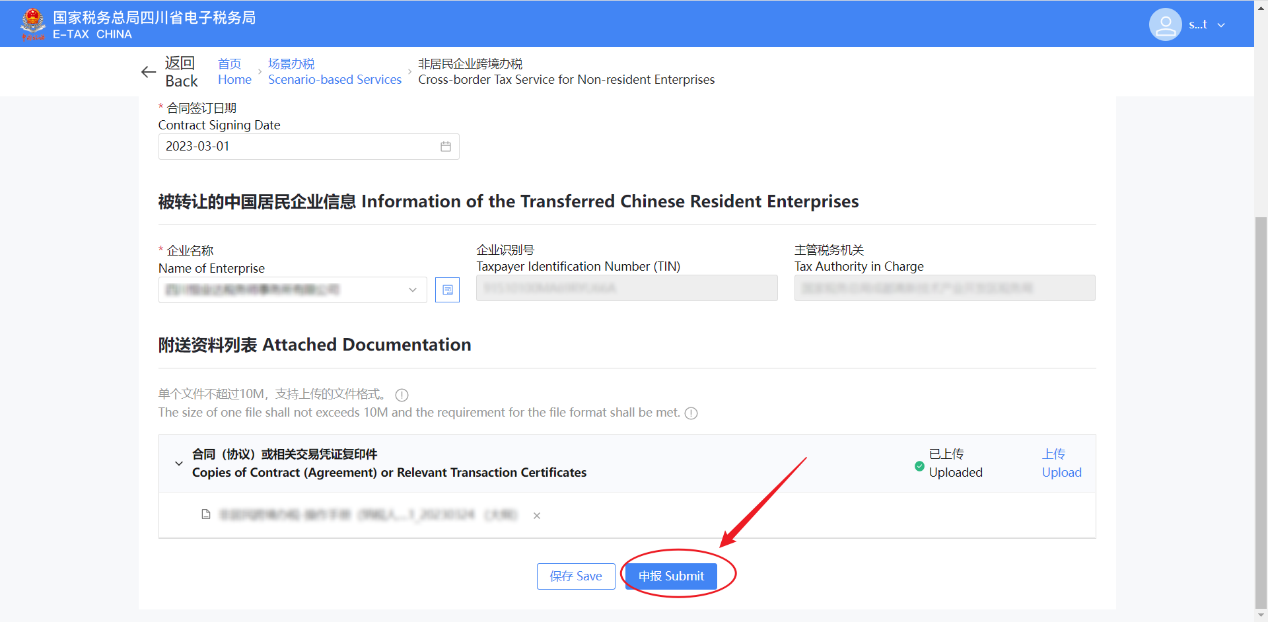

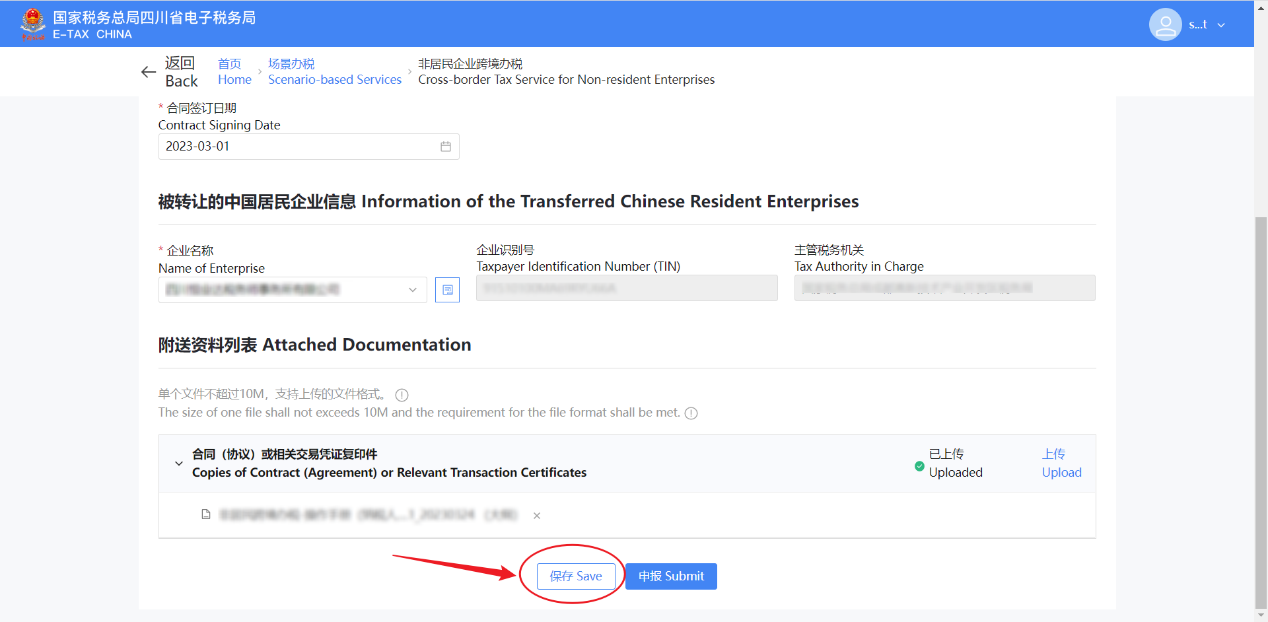

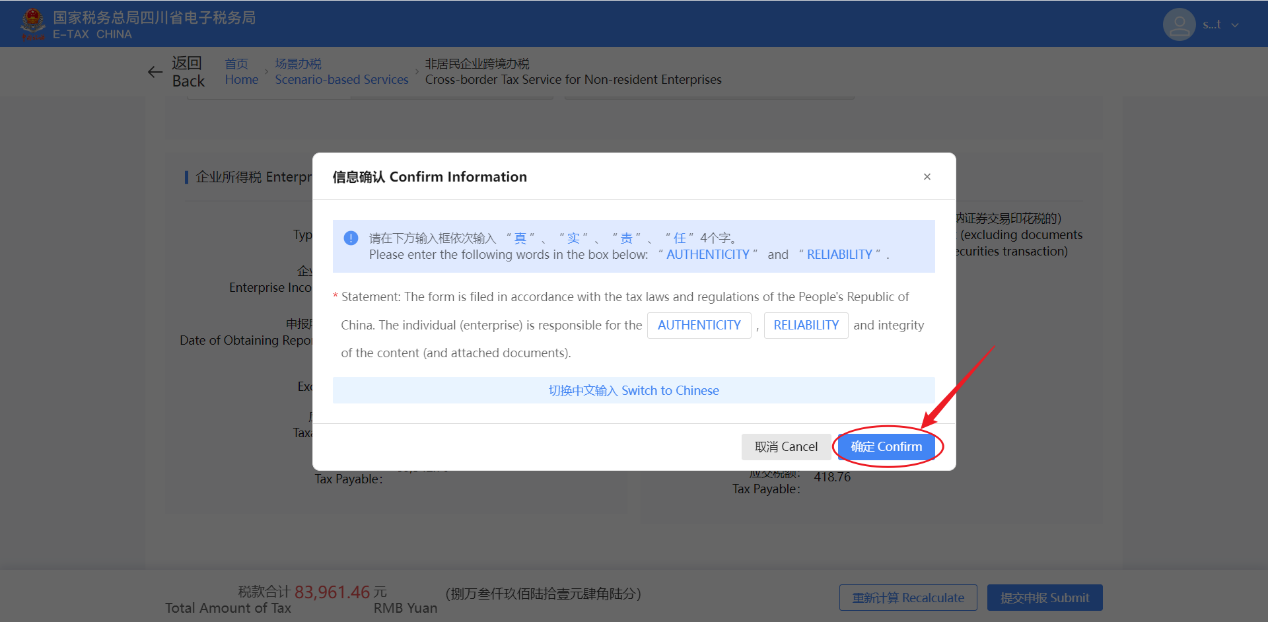

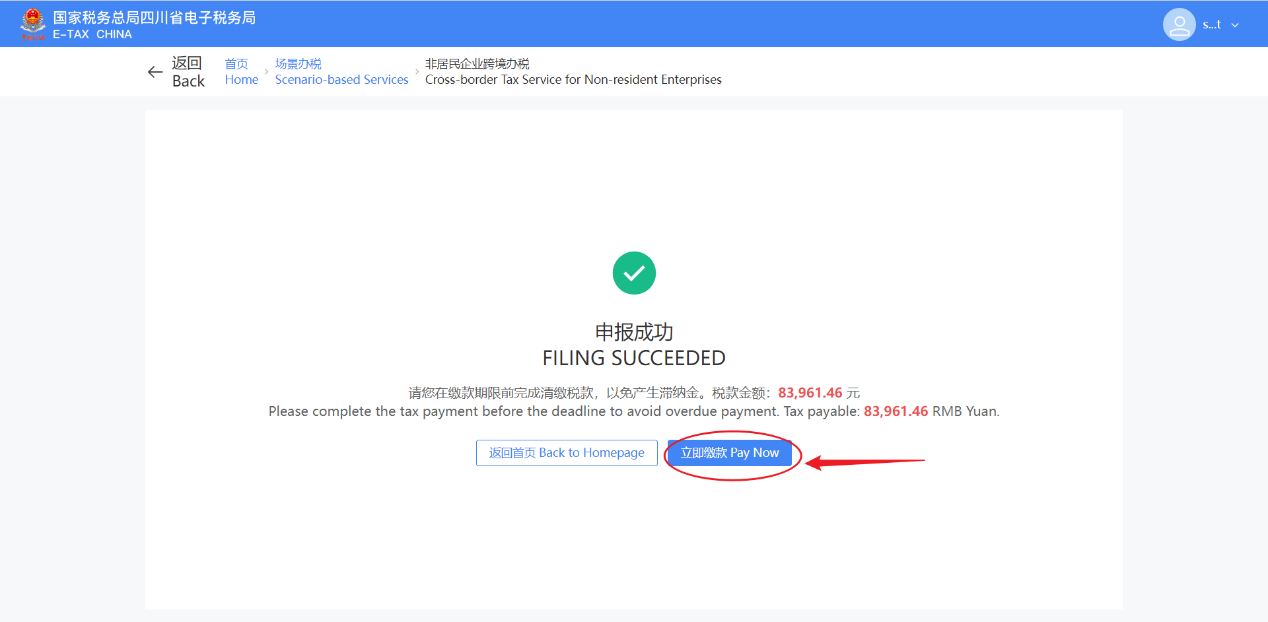

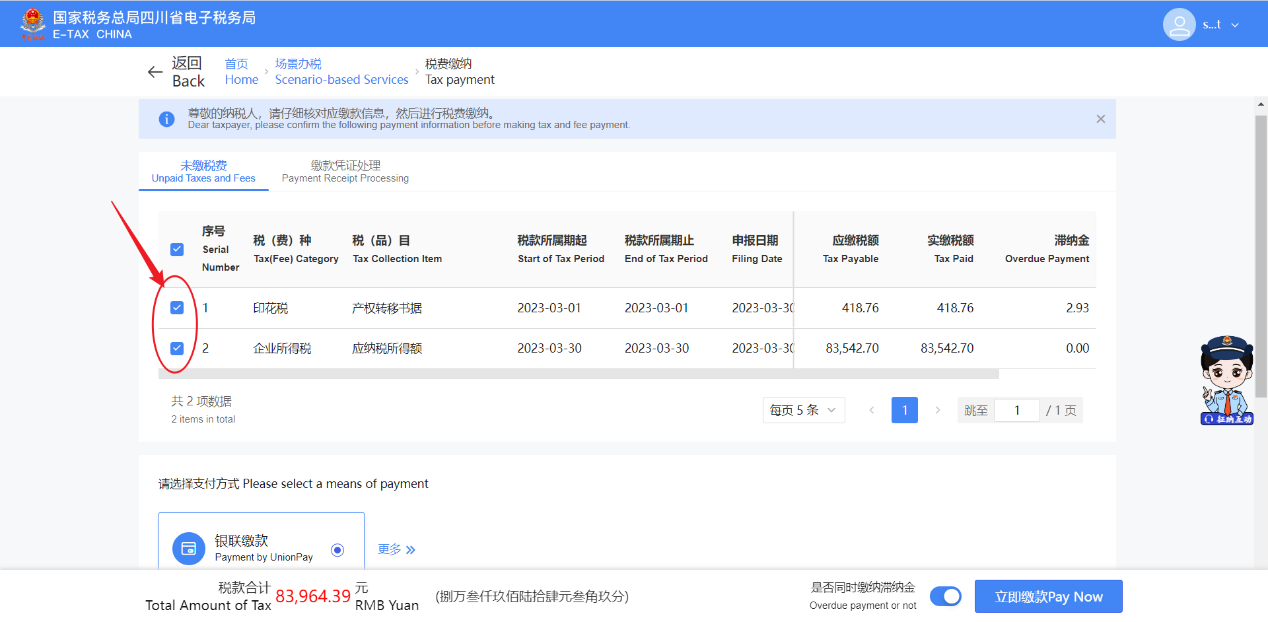

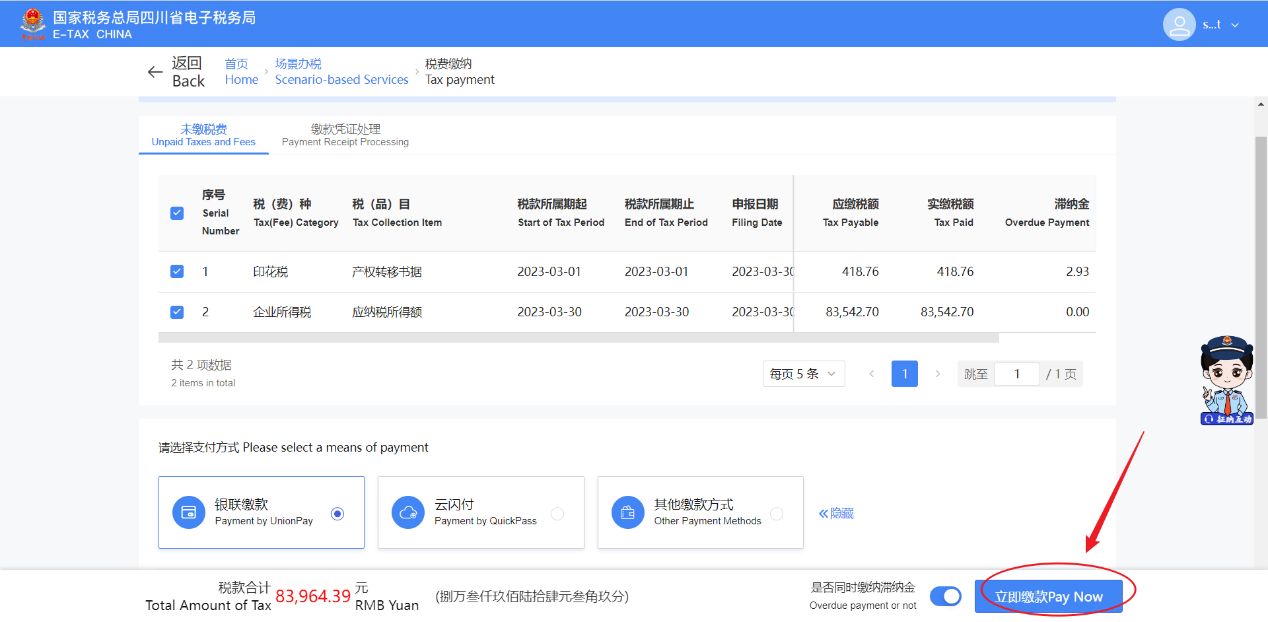

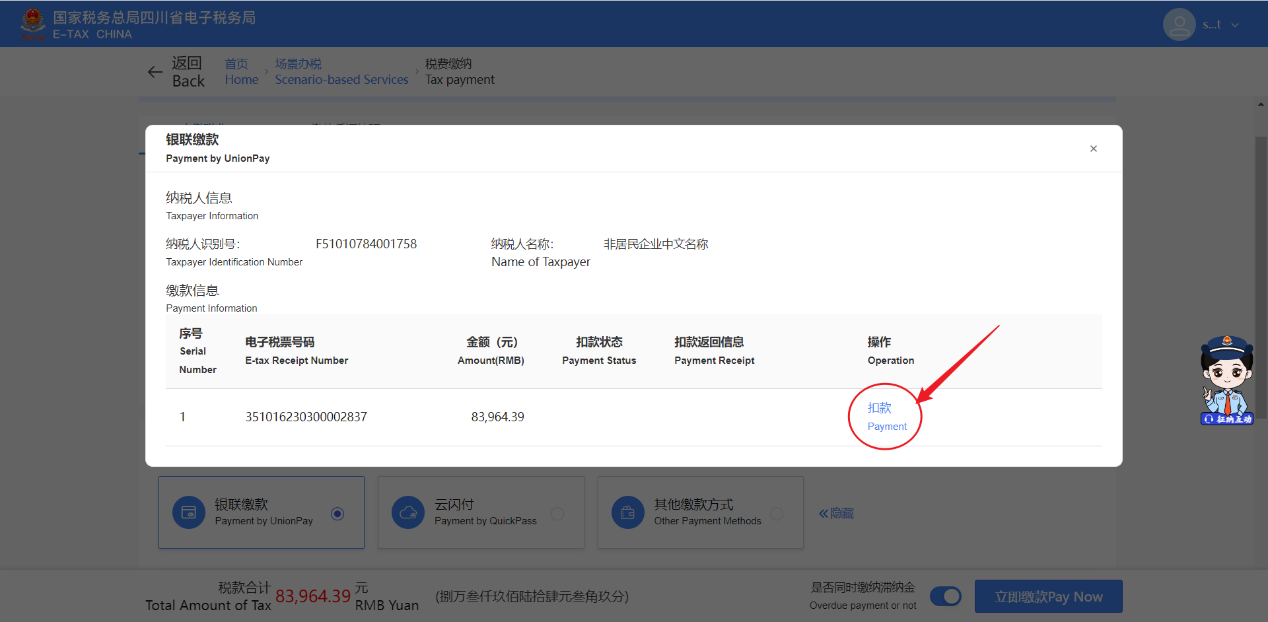

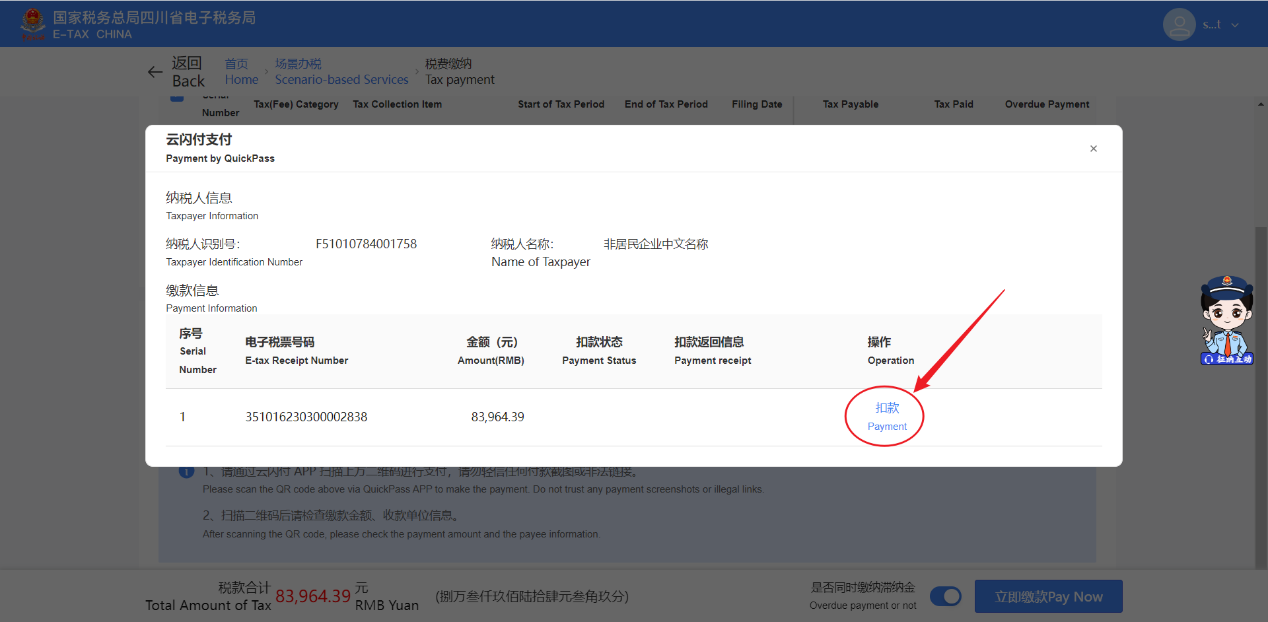

Personal Affairs Employment Residency Permit Stay Permit Visas Certificate of No Criminal Record Immigration and Customs Marriage and Birth Checkpoints Accommodation Pet Dog Services VAT Refunds Enterprise Affairs Establishment and Alteration Annual Inspection Bankruptcy and Cancellation of Registration International Taxation Employment Environmental Protection Cross-border Tax Service for Non-resident Enterprises

-

Business

Industrial News Business Environment Investment Policies Investment Guide Investment Promotion Agency Key Industries Success Cases Special Functional Areas

-

Travel

Natural Landscapes Cultural Attractions Travel Agencies Travel Guide

-

Life Guide

Education International Schools Kindergartens Municipal Schools District Schools Universities Hospitals City Hospitals District Hospitals Cultural Facilities Libraries Theatres Galleries Cultural Blocks Brand Cultural Activities Book Stores Sports Facilities Transport Flight Trains Coaches Buses Metro Ports Drive Taxis Bicycles Shekou Cruise Homeport Banks Utilities and Communications

- Laws

- Contact Us